The Epoch Times

published on July 16, 2021

The Edge Singapore

published on June 20, 2016

Wan Bao

published on May 28, 2017

aspire.sharesinv.com

published on July 28, 2016

WHY YOU SHOULD NOT SURRENDER YOUR LIFE INSURANCE OR ENDOWMENT PLAN

Getting insured in some way or another is very important for all of us – no one knows when we might (touch wood) meet with an accident or worse.

One of the most common ways to get insured for unexpected occurrences is to buy either a whole life insurance or endowment plan.

These policies typically mature either after 10 to 20 years or when the policyholder meets with an accident (touch wood again).

Most endowment plans (we’ll stick to endowment plans for simplicity’s sake) would require the policyholders to pay monthly premiums and the amount varies across different extents of coverage.

But you should almost never “surrender” these policies, at least not to your original insurance provider, which we would shed some light in just a bit.

But if you’re busy and don’t have the time to read all of it, click here for the TL;DR version.

What if We Face Financial Difficulties Along the Way…

So, what happens if we somehow don’t have the ability to continue paying the monthly premiums until the maturity date?

Most Singaporeans would terminate the endowment plan and “surrender” all the premium they’ve paid, sometimes receiving very little value compared to the amount that they’ve paid over the months or years.

Otherwise, automatic policy loan (APL) will kick in to fund the premium. The problem of APL is the interest charge on the loan is about six percent per annum, which is often higher than the returns from policies. It will erode the cash value of policy over time.

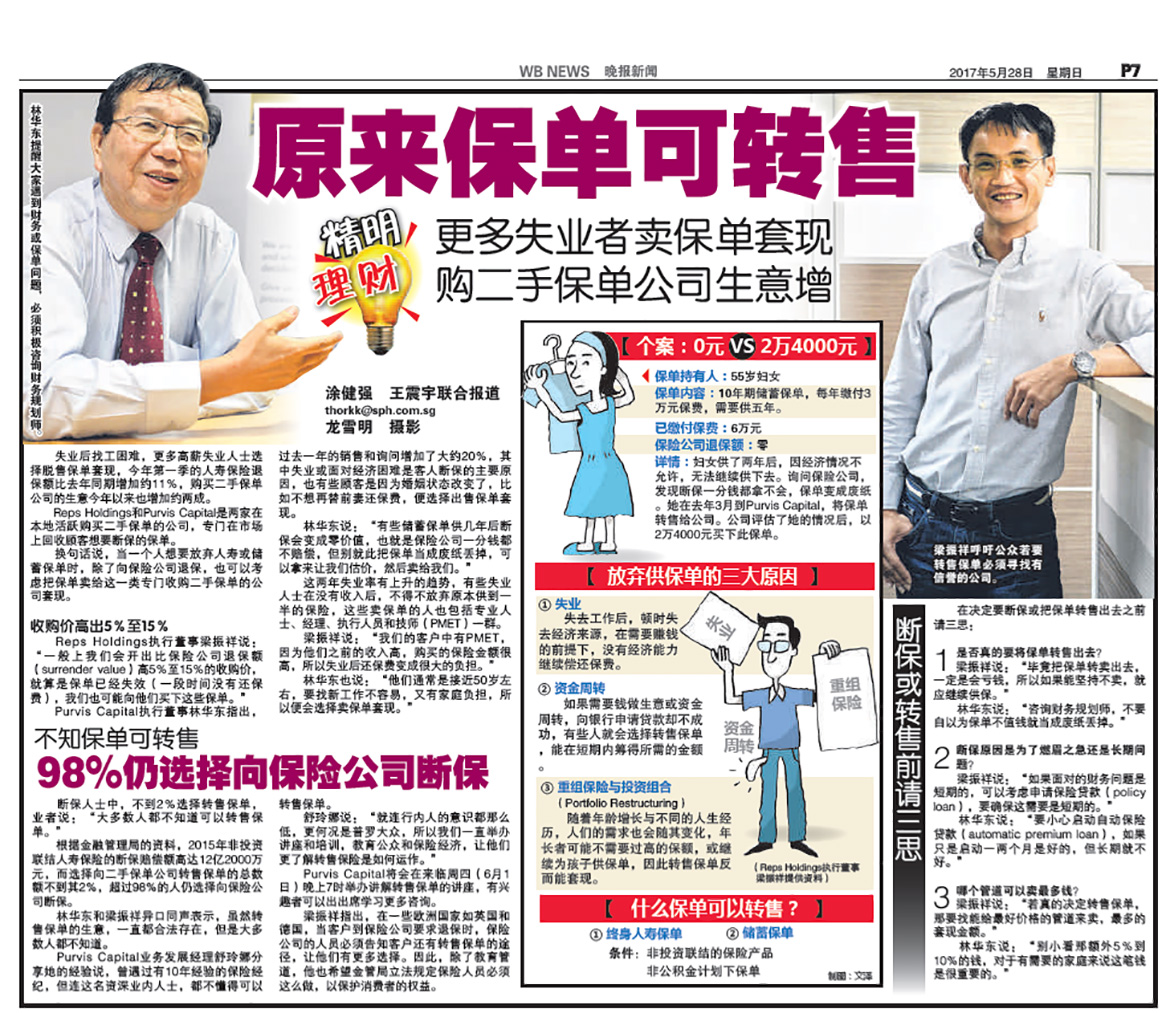

Executive Director of Phillip Securities and founder of Purvis Capital (a little more on Purvis later on) Lim Wah Tong reveals that Singaporeans actually have another option: sell the endowment plan to a third party or highest bidder for a better value.

When we sell a used car, we do not have to sell it back to the original car dealer. We sell to the highest bidder. “Surrendering” a policy is no different.

Selling to Third Parties is a Much Better Deal

Lim and his other colleagues at PhillipCapital started Purvis Capital, a financial intermediary.

They buy the endowment plans and other life insurance policies from policyholders who intend to surrender policies before the maturity date because of varying circumstances.

It could be attributed to change in marital status, no necessity of coverage or reallocation of funds for other investments.

When Purvis Capital or other intermediaries buy from policyholders, they step into the shoes of the insured. Everything is transferred to the former – benefits like the maturity payout; and also the risk if the insurance provider were to default.

Lim said that most intermediaries would usually offer a price that is three- to ten-percent more than if policyholders were to “surrender” to their insurers.

According to Lim, Purvis once offered $24,000 for an endowment plan that was supposedly more or less worthless if it were to be surrendered instead.

The $24,000 was 80 percent of the one-year premium of $30,000; the policyholder paid premiums for two years and would have gotten close to nothing if he had surrendered instead.

Purvis had also resuscitated policies where policy loan exceeds surrender value. Net surrender value is negative. Purvis paid up the loan and also offer policyholders a payout.

Why Such a Huge Difference Between Surrendering and Selling to Third Parties?

Lim explains that most insurance policies are “front-end loaded” – most of the cost and expenses incurred by policyholders are charged upfront.

Financial intermediaries like Purvis Capital also operates on a lower cost structure versus the insurer’s cost structure. The most significant reason is still the economic law of supply and demand.

This is one of the biggest reasons why Purvis and other third parties are able to offer much more attractive prices for these “used” endowment or life policies, as compared to the insurers.

Policyholders should see their life/endowment policies through to maturity to enjoy the full protection and investment returns of policies. Surrendering ought to be the last option.

We Don’t Know This Because Insurers are Not Obliged to Tell Us

In other countries, knowing options like these is actually a consumer’s right but in Singapore, unfortunately, it isn’t.

Lim thinks that insurance companies and agents should do their part by providing this option to us policyholders – our money is at stake!

Undoubtedly, insurance companies get hit quite badly themselves if policyholders were to end their endowment plans or other insurance policies early.

But they should consider that letting us know about such options would not only be good for us – but also themselves.

If intermediaries buy these “used” endowment plans, nothing changes for insurance companies, they still get paid the premiums every month.

For those who are interested in finding out how much your endowment plans are worth, if you were to sell it now, you may head over to Purvis Capital’s website for a quote.

TL;DR

- Everyone needs insurance but things get complicated when you start paying premiums for a life insurance or endowment policy.

- But when you can pay the expensive monthly or annual premiums, you have to terminate or “surrender”, which almost always result in your losing most if not all your paid premiums.

- What insurers don’t tell Singaporeans is we can actually “sell” and transfer the policy to third-party financial intermediaries. Third parties would then pay us more than our original insurers (three to ten percent, or even more).

- In return, they will pay our monthly premiums but they will get the payouts and also bear the risk if the insurance provider were to default.

- Financial intermediaries are able to pay more because they operate on a lower cost structure versus the insurers’.

- Bottomline: Seek a quote from a financial intermediary for your endowment if you wish to “surrender”.